Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

12-31-2013, 03:47 AM

(This post was last modified: 07-14-2016, 10:47 PM by admin.)

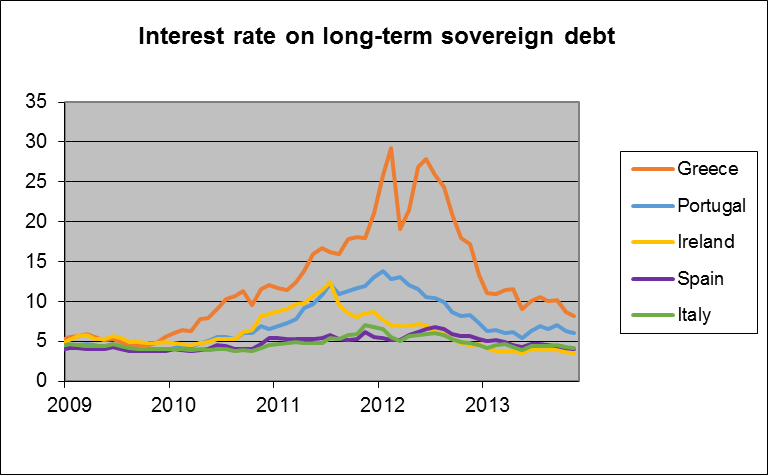

After a wild ride in 2011-2012, interest rates have settled down on European sovereign debt. For now.

Yields on long-term government bonds, Jan 2009 to Nov 2013. Data source: Eurostat.

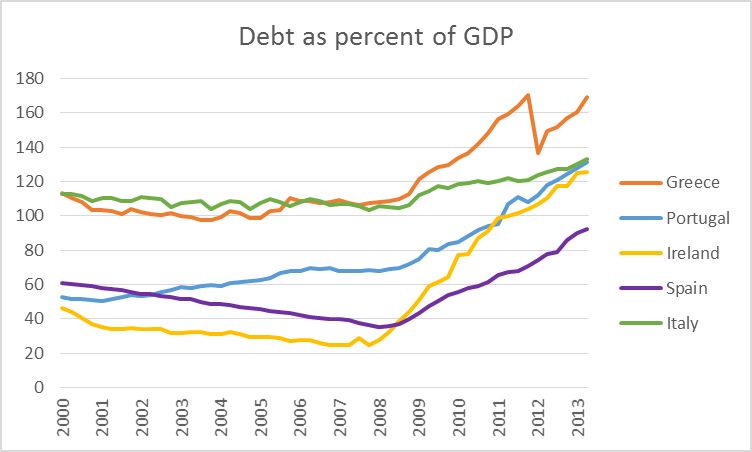

Greek yields fell sharply following the PSI agreement in March 2012, a de facto default that ended up reducing the value of Greek’s debt by 20%. But as a result of ongoing deficits and plunging GDP, the ratio of debt to GDP for Greece is now almost back up to where it was in at the end of 2011. In the mean time, debt/GDP has continued its uninterrupted climb for Portugal, Ireland, Italy, and Spain.

General government debt as a percent of GDP, 2000:Q1-2013:Q2. Data source: Eurostat.

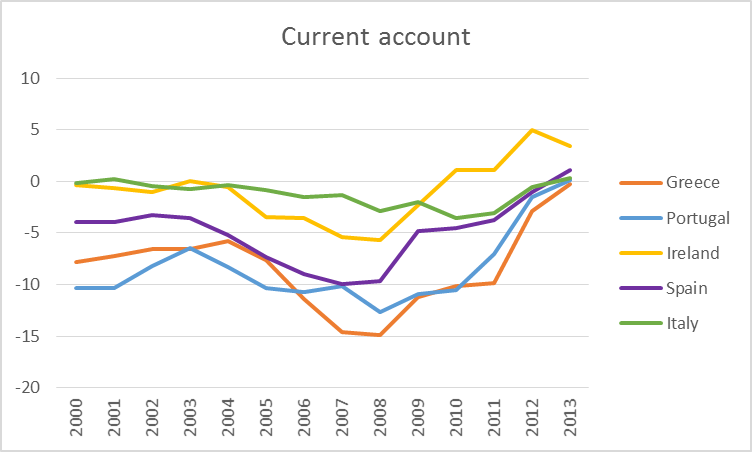

On the other hand, these countries have seen sharp improvements in their current account, having gone in a very short period from large deficits to outright surpluses. Unfortunately, this seems not so much due to currency depreciation or wage and price adjustments restoring competitiveness as it has to the collapse in aggregate spending (on both home and foreign goods) associated with the sharp economic downturns in these countries.

Historical and projected current account surplus as a percent of GDP, annual, 2000-2013. Data source: IMF.

Still, the improved current accounts mean less borrowing from abroad and reduced vulnerability to shifting moods of international credit markets. My recent paper with Greenlaw, Hooper, and Mishkin (and much previous research before us) identified the debt-to-GDP ratio and current-account deficits as two key factors that influence a country’s vulnerability to sudden spikes in borrowing cost. One distinctive feature we found in the data was a strong nonlinear interaction between the current-account deficit and debt loads. Our paper used a 5-year average of the current-account/GDP ratio as the variable that interacts with the current debt load to predict the interest rate on a country’s long-term sovereign debt. I was curious to see what our estimates would imply if we assumed that the recent improvements in the current account turn out to be permanent.

The table below summarizes how debt, the current-account surplus, and interest rate on government debt have changed since 2012 for these 5 European countries. The final column gives the amount by which the 10-year yield on government debt would be predicted to fall if debt/GDP changed by the amount indicated in columns (2) and (3) and the change in the current-account surplus given in columns (4) and (5) is assumed to be permanent. Much of the observed drop in yields could be explained by the elimination of big current-account deficits.

Debt as a percent of GDP in 2011 and 2013:Q2, current-account surplus as a percent of GDP over 2007-2011 and projected for 2013, interest rate on 10-year sovereign bonds in 2012 and November 2013, actual change in yields, and predicted change in yields based on equation (18) in Greenlaw, Hamilton, Hooper, and Mishkin (2013).

|

|

DEBT/GDP |

CURRENT-ACCOUNT/GDP |

INTEREST RATE |

ACTUAL |

PREDICTED

|

|

|

2011 |

2013:Q2 |

2007-2011 |

2013 (PROJ) |

2012 |

NOV 2013 |

CHANGE |

CHANGE

|

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8)

|

|

Greece |

170.6 |

169.1 |

-12.1 |

-0.3

|

22.9 |

8.2 |

14.7 |

11.2

|

|

Portugal |

108.0 |

131.4 |

-10.2 |

0.1

|

11.0 |

6.0 |

5.0 |

4.2

|

|

Ireland |

106.5 |

125.7 |

-2.2 |

3.4

|

6.0 |

3.5 |

2.5 |

1.8

|

|

Spain |

69.1 |

92.3 |

-6.5 |

1.1

|

5.9 |

4.1 |

1.8 |

1.1

|

|

Italy |

120.8 |

133.3 |

-2.5 |

0.3

|

5.5 |

4.1 |

1.4 |

0.9 |

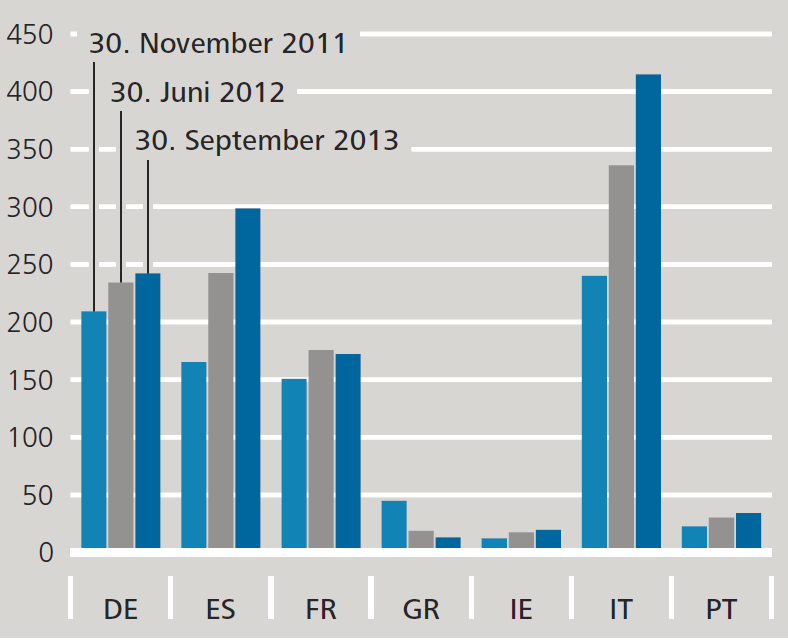

An improving current-account balance means less borrowing from abroad. So who is funding the growing sovereign debt? The answer appears to be domestic banks. The Telegraph’s Ambrose Evans-Pritchard leads us to page 33 of this

report from the German central bank which reports that Spanish monetary financial institutions increased their holdings of Spanish government debt by € 134 billion between November 2011 and September 2013. That’s an 81% increase and accounts for 65% of the total increase in Spanish sovereign debt over the period. Italian banks increased their holdings by € 175 billion, a 73% increase which accounts for more than 100% of the increase in Italian sovereign debt.

Sovereign debt held by domestic monetary financial institutions. Source: Bundesbank.

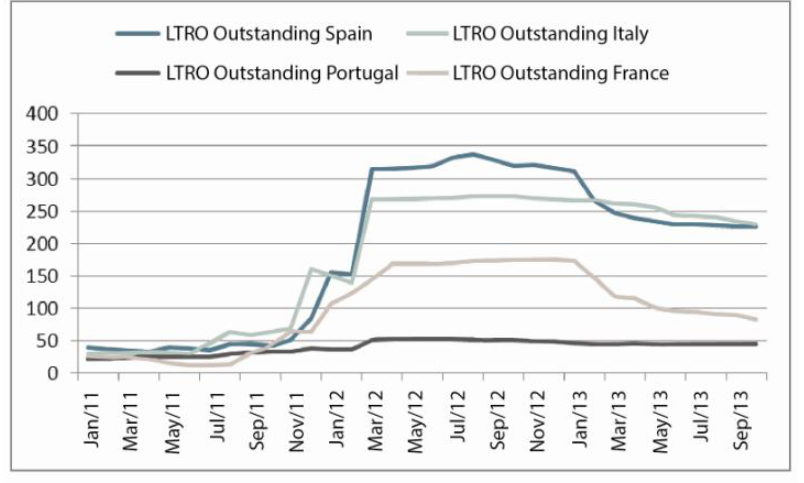

And where did the banks get the funds to lend to the government? From the ECB, whose outstanding loans to Spanish and Italian banks come close to half a trillion euros.

Outstanding ECB LTRO loans to institutions from selected countries in billions of euros. Source:

This is a fine deal for the banks, borrowing from the ECB at a lower rate than they can earn on the sovereign debt. But it does not change the underlying reality. Greece’s debt load of 170% of GDP and interest rate in excess of 8% means that its taxpayers must surrender 14% of the country’s total income every year just to make interest payments on the debt. Portugal needs to sacrifice 8% every year. Neither is going to happen; further defaults seem unavoidable.

But if the ECB does not keep renewing the LTRO loans, rates would spike back up and we’d replay last year’s excitement in financial markets.

This can will be kicked down the road.

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

A new German plan to impose "haircuts" on holders of eurozone sovereign debt risks igniting an unstoppable European bond crisis and could force Italy and Spain to restore their own currencies, a top adviser to the German government has warned. “It is the fastest way to break up the eurozone,” said Professor Peter Bofinger, one of the five "Wise Men" on the German Council of Economic Advisers. "A speculative attack could come very fast. If I were a politician in Italy and I was confronted by this sort of insolvency risk I would want to go back to my own currency as fast as possible, because that is the only way to avoid going bankrupt,” he told The Telegraph.

German 'bail-in' plan for government bonds risks blowing up the euro - Telegraph

The risk spread on Portugal’s 10-year debt surged to 410 basis points over German Bunds last week, pushing borrowing costs back to unsustainable levels in real terms. Portugal’s public debt is 132pc of GDP. Total debt is 341pc, the highest in Europe. The country is in a debt-deflation trap and requires years of high growth to escape. “Portugal is close to losing market access,” said Mark Dowding, from bond manager Blue Bay. “We saw very ugly conditions last week, and large US managers invested in Portugal have been looking to exit those positions. With fund redemptions going on, it is a perfect storm.”

German 'bail-in' plan for government bonds risks blowing up the euro - Telegraph

Portugal's Prime Minister has had less than three months on the job to try to turn around the lagging economy. Yet, he has already announced plans to undo some of the measures introduced by his predecessors as part of Portugal's bailout by the IMF and the European Union (EU). For example, he hopes to increase state salaries, raise family incomes, reduce austerity measures, and make other changes designed to improve the economic situation of the common Portuguese citizen. While these measures may be popular with voters, the IMF has its concern. Recently, it has said that Costa's proposed budget "implies a loosening of the fiscal stance." Per the IMF's estimates, if the budget is adopted in its current state, it will create a deficit of 3.2% of gross domestic product (GDP) by the end of 2016. That nearly doubles the deficit of 1.8% experienced under the prior administration's stability programs.

IMF Says Portugal's Growth Constrained by Heavy Debts | Economy Watch

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

The IMF predicts that Portugal's plans may have disastrous consequences. "The banking system's balance sheets need to be strengthened to avoid further negative surprises and protect taxpayers...A more ambitious approach to corporate debt workouts is needed."

IMF Says Portugal's Growth Constrained by Heavy Debts | Economy Watch

“External demand will accelerate in 2016, sustained by the recovery of European economies,” the government said in a statement after a cabinet meeting. It sees economic growth of 2.1 percent in 2016, more than the European Commission’s Nov. 5 forecast for a 1.7 percent expansion.

Portugal Sets Narrower 2016 Deficit Target, Sees Faster Growth - Bloomberg Business

Earlier this week, Spanish newspaper El Pais reported that Portugal's largest bank, Caixa Geral de Depósitos (CGD), an institution that holds nearly one-third of all deposits in the country, is on the brink of destruction following a horrendous first quarter of the year. The bank is thought to need a cash injection of as much as €4 billion (£3.04 billion, $4.45 billion) to rescue it from serious difficulties. That number amounts to roughly 2.5% of Portugal's GDP.

HSBC analysis: Portuguese economy and banking sector - Business Insider

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

Barclays expects Portuguese growth to slide post-Brexit, from an expected 0.7 percent in 2016 to just 0.3 percent in 2017. According to the European Commission, Portuguese GDP (gross domestic product) grew by 1.5 percent in 2015. Barclays predicts the total capital needs for Portuguese banks to be at 7.5 billion euros ($8.3 billion), including roughly 5 billion euros for state-owned Caixa Geral, the country's second largest bank. Other financial data are equally downbeat, as, for example, Barclays forecasts Portugal's deficit to fall only by a small margin, to 4.1 percent of GDP from 4.4 percent in 2015. The country's public debt tells a similar story, as Barclays predicts it to increase from 130 percent of GDP in 2015 to roughly 132 percent in 2016, remaining above 130 percent throughout the next decade. Barclays also predicts that Portugal will require 8.9 billion euros of funding for the rest of 2016, with annual borrowing averaging at 23.4 billion euros for 2017 to 2020. But, according to the Barclays note, published by a team of analysts led by Antonio Garcia Pascual, the government's inability so far to implement a realistic medium-term fiscal plan compatible with solvency is most pressing.

Portugal winning at soccer, but its economy may be fighting a losing game

The International Monetary Fund slightly lowered its 2016 and 2017 growth forecasts for Italy, saying the U.K.’s decision to leave the European Union will increase uncertainty and will likely weigh on the country’s economic performance.

IMF Lowers Forecasts for Italy’s Economic Growth - WSJ

France’s rigid labor market rules are still hampering growth and should be the focus of government efforts to modernize the economy, the International Monetary Fund said. “A key obstacle to growth remains the labor market,” the Washington-based fund said in its Article IV report on France. “Structural unemployment is projected to remain high in the absence of additional reforms. In an environment with modest medium-term growth prospects at home and in the euro area, France thus faces two central policy challenges: to support a more rapid creation of new private sector jobs and to ensure the sustainability of public finances.”

France’s Labor Market Remains Key Obstacle to Growth, IMF Says - Bloomberg

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

The Italian government, which failed to gain European Union backing for a bad bank just months ago, is sounding out regulators on ways to shore up its banks after their shares were hammered following the U.K.’s vote to secede from the bloc. Valdis Dombrovskis, a vice president of the European Commission, said on Tuesday that the EU’s executive arm is “closely monitoring the situation with the banking sector in Italy” and is “in close touch with the Italian authorities as regards possible steps.” Various options are under discussion, “so I cannot comment in more detail right now,” he said in an interview in Brussels.

Italy Explores Bank-Rescue Options With EU on Brexit Losses - Bloomberg

The city has roughly €13.6 billion ($15.2 billion) in debt and more than 12,000 creditors—though the pile is so complex no one really knows how much is owed to whom. Rome faces outstanding bills for operating its 61-year-old metro system, hauling trash, and running a network of unprofitable pharmacies that compete with private shops. The courts are grappling with hundreds of lawsuits over unpaid debts going back 50 years for land expropriated to build hospitals, streets, and other city projects—including some debts connected to the 1960 games, former Mayor Ignazio Marino has said.

Populist Politicians Take On Italy’s Massive Debt Pile - Bloomberg

However, Brussels is refusing to budge, and senior banking sources believe Renzi could press ahead with a €40bn bailout. Such a move would be the equivalent of throwing a hand grenade at the entire EU project. By flouting state aid rules, it throws into question the future of the banking union, a central pillar of the eurozone. Also, by setting a precedent for bank bailouts, it paves the way for countries such as Portugal, where the financial system is also under strain, to suddenly do the same, therefore undermining the EU’s entire credibility. Forget the Greek crisis – this is Europe’s biggest test yet.

Italy’s wrangle with Europe will dwarf Brexit shock

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

The government of Italian Prime Minister Matteo Renzi on Friday put the finishing touches on his signature employment reforms which he says are already rousing a sclerotic labour market despite fierce resistance from trade unions. The final steps approved by cabinet aim to make job centres more efficient, broaden unemployment benefits and give employers more power to monitor their workers' performance. They complete a policy package first presented by Renzi 15 months ago.

Italy's Renzi completes labour reform, growth needed for jobs | Reuters

Over the past 18 months, Renzi has tackled the labor market, the banking sector, education and the public administration, among other areas, even though few reforms are yet operational and their long-term impact remains to be seen.

Businesses hail Renzi's reforms, urge more to speed Italy's upturn | Reuters

Monte dei Paschi was first founded in Siena in 1472, making it the oldest existing bank on earth, but shares have lost more than 99% of their value since the pre-financial crisis years. There are also big fears about the amount of poor quality assets and loans the bank has on its books. The bank's chief executive, Fabrizio Viola, is currently in the middle of a battle to make it profitable again, by, amongst other things, dumping risky assets.

Monte dei Paschi di Siena buyout rumours - Business Insider

Out of many of the euro zone's banking systems, Italy's has been one of the most scrutinized, with the sector facing some 360 billion euros ($411.5 billion) in bad loans. However, despite the turbulence, experts suggest the country's financial system isn't nearly as bad as the market thinks. "The actual issue of the Italian banking system has been by far highly overestimated," Valerio De Molli, managing partner of The European House – Ambrosetti, told CNBC on the sidelines of the Ambrosetti workshop, over the weekend. "If you look into the gross amount of non-performing loans (NPLs), you have quite an immense figure; we are the worst in Europe in comparison to total lending. We are one third higher than European average, that's bad." "However, if you look into the net figures, all relevant banks have already amortized those costs and eventual risks. So that's one fact which is underestimated and under-evaluated in my opinion."

Here’s how toxic Italy’s bad loans really are

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

The bank fund set up by Italian financial institutions to help weaker, smaller lenders is a "private sector initiative" and "market-based" as far as intervention is concerned, Italy's finance minister said on Thursday, keen to stress that the deal involves no state aid. Italy agrees $5.7B fund to rescue weaker lenders "It's not a bailout. It's a vehicle," Pier Carlo Padoan told CNBC on Thursday. The fund is a private-sector initiative to buy up struggling Italian lenders' bad loans and was set up in response to growing concern over the country's banking sector. Shares in Italian banks have fallen sharply since the start of the year as fears over non-performing loans on their books grew. The fund is an attempt at easing those fears, and Italy is keen to present it the fund as privately run to avoid scrutiny from European Union regulators who could argue that it amounts to state aid.

Italy bank fund ‘no state aid, not a bailout’: FinMin

European Central Bank President Mario Draghi weighed in–ever so tentatively–on behalf of his compatriot Matteo Renzi Thursday in a simmering row over how to fix Italy’s broken banks. In an otherwise low-key press conference, Draghi said that the availability of state bailouts to recapitalize banks was an important part of solving the problem of non-performing loans and restoring banks to a position where they could lend more freely to creditworthy customers. “A public backstop is a measure that would be very useful,” Draghi said, although he made sure to qualify his comments by listing other essential measures. A furious ideological row is brewing between Italian Prime Minister Matteo Renzi and the European Commission over the issue.

The ECB Just Backed Matteo Renzi in Italy's EU Bank Bail-in Dispute

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

08-03-2016, 01:44 AM

(This post was last modified: 08-03-2016, 01:45 AM by admin.)

I think if there is a meltdown, particularly if it spreads to UniCredit, then other banks in Europe will also face problems. I think Deutsche Bank has potential to have problems. The nature of their business is such that the very low interest rates and the fact that there isn’t much difference between long-term rates and short-term rates is problematic for them because of their business model. So, there is likely to be some contagion. Once it starts, it’s very difficult to stop because I don’t think people understand what’s going on, and they are going to be quite surprised by these new bail-in rules. That in itself will cause significant problems both for small retail investors and, potentially, institutional investors.

Why Italy’s Banks Are a ‘Doom-Loop’ Risk that Could Bury the Eurozone - Knowledge@Wharton

The International Monetary Fund’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory.

IMF admits disastrous love affair with the euro and apologises for the immolation of Greece

Posts: 2,904

Threads: 58

Joined: Mar 2012

Reputation:

259

Greece needs to be the permanent host to the Olympic Games. That would solve a lot of problems.

Posts: 12,025

Threads: 1,809

Joined: Apr 2008

Reputation:

227

'ArtM72' pid='75318' datel Wrote:Greece needs to be the permanent host to the Olympic Games. That would solve a lot of problems.

Actually, since ever fewer countries wants to host these, that kills two birds with one stone. The bigger problem is Italy, however:

-

They can't recapitalize their banks with public money because of eurozone bail-in rules

-

They can't revive their economy and get off the deflationary trajectory like the Czechs did, as they cannot devalue

-

So they're forced to 'internal' devaluation to recouping lost competitiveness, undercutting German inflation which is almost zero. But this deflates nominal GDP, which wrecks havoc with debt dynamics. It's a ticking time bomb.

|