5 Stocks Under $10 Set to Soar - views

MADISON, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Just take a look at some of the hot movers in the under-$10 complex from Wednesday, including Comstock (CHCI), which skyrocketed higher by 30.6%; Ever-Glory International Group (EVK), which soared higher by 27.8%; Genetic Technologies (GENE), which surged by 21.9%; and Cal Dive International (DVR), which boomed to the upside by 19.3%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

>>5 Stocks Insiders Love Right Now

One low-priced stock that recently broke out and skyrocketed higher was solar energy player Enphase Energy (ENPH), which I highlighted in April 25's "5 Stocks Under $10 Set to Soar" at around $6.30 a share. I mentioned in that piece that ENPH had been uptrending strong for the last six months and was quickly moving within range of triggering a major breakout trade. That trade was set to trigger if ENPH managed to clear some near-term overhead resistance levels at $6.36 to $6.70 a share and then once it took out some past resistance at $6.89 a share with high volume.

Guess what happened? Shares of ENPH went on to trigger that breakout the following trading session with above-average volume. The stock briefly pulled back to around $6.59 a share and then resumed its uptrend and broke out again above $8 a share in early May. Shares of ENPH have continued to soar higher since triggering that breakout and it recently tagged a new 52-week high of $10 a share. That represents a monster gain of over 50% in a very short timeframe for anyone who played the breakout.

>>5 Hated Earnings Stocks That Deserve Your Love

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

I'm not as eager to recommend investing long-term in stocks that trade less than $10 a share because these names can be very speculative, and the odds for picking the long-term winners aren't great. But I definitely love to trade stocks that are priced below $10. I like to view them as a trading vehicle with lots of volatility and lots of upside when the trade is timed right.

>>5 Toxic Stocks to Sell in May and Go Away

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

>>5 Rocket Stocks to Buy This Week

Strategic Hotels & Resorts

One under-$10 stock that's trending within range of triggering a major breakout trade is Strategic Hotels & Resorts (BEE), which operates as a self-administered and self-managed real estate investment trust. This stock is off to a hot start in 2013, with shares up 28%.

If you take a look at the chart for Strategic Hotels & Resorts, you'll notice that this stock has just started to trend back above its 50-day moving average of $8.10 a share with heavy upside volume. Volume on Wednesday registered 4.02 million shares, which is well above its three-month average of 2.08 million shares. That move is quickly pushing shares of BEE within range of triggering a major breakout trade.

>>5 Stocks Rising on Unusual Volume

Traders should now look for long-biased trades in BEE if it manages to break out above some near-term overhead resistance levels at $8.30 to its 52-week high at $8.55 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 2.08 million shares. If that breakout triggers soon, then BEE will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $10 to $12, or even $15 a share.

Traders can look to buy BEE off weakness to anticipate that breakout and simply use a stop that sits just below some near-term support levels at $7.90 to $7.75 a share. One can also buy BEE off strength once it takes out those breakout levels with volume and then simply use a stop that sits just below its 50-day at $8.10 a share, or around $7.90 a share.

Zix

Another under-$10 stock that's quickly moving within range of triggering a major breakout trade is Zix (ZIXI), which provides email encryption services. This stock has been booming to the upside so far in 2013, with shares up 37%.

If you take a look at the chart for Zix, you'll notice that this stock has just started to surge back above its 50-day moving average of $3.69 a share with decent upside volume. Volume on Wednesday registered 506,000 shares, which is just above its three-month average action of 443,108 shares. That move is quickly pushing shares of ZIXI within range of triggering a major breakout trade.

>>3 Tech Stocks Spiking on Big Volume

Market players should now look for long-biased trades in ZIXI if it manages to break out above some near-term overhead resistance levels at $3.82 to its 52-week high at $3.94 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 443,108 shares. If that breakout triggers soon, then ZIXI will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $4.50 to $5 a share, or even $5.50 a share.

Traders can look to buy ZIXI off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support levels at $3.60 to $3.55 a share. One can also buy ZIXI off strength once it clears those breakout levels with volume and then simply use a stop that sits just below its 50-day at $3.69 a share, or at around $3.60 a share.

RTI Biologics

One under-$10 name that's trending within range of triggering a near-term breakout trade is RTI Biologics (RTIX), which is engaged in the use of natural tissues and innovative technologies to produce orthopedic and other surgical implants that repair and promote the natural healing of human bone and other human tissues and improve surgical outcomes. This stock is off to a flat start in 2013, with shares up just 0.7%.

If you take a look at the chart for RTI Biologics, you'll notice that this stock has been uptrending strong for the last month, with shares moving higher from its low of $3.60 to its recent high of $4.42 a share. During that uptrend, shares of RTIX have been mostly making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of RTIX within range of triggering a near-term breakout trade.

>>8 Stocks Under $10 Trending Sharply Higher

Traders should now look for long-biased trades in RTIX if it manages to break out above some near-term overhead resistance levels at $4.40 to $4.42 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 274,877 shares. If that breakout triggers soon, then RTIX will set up to re-test or possibly take out its next major overhead resistance levels at $4.80 to its 52-week high at $5.11 a share. Any high-volume move above $5.11 will then give RTIX a chance to run north of $6 a share.

Traders can look to buy RTIX off weakness to anticipate that breakout and simply use a stop that sits right below its 200-day at $4.06 a share or below its 50-day at $3.91 a share. One can also buy RTIX off strength once it clears those breakout levels with volume and then simply use a stop that sits right below its 200-day at $4.06 a share.

Ziopharm Oncology

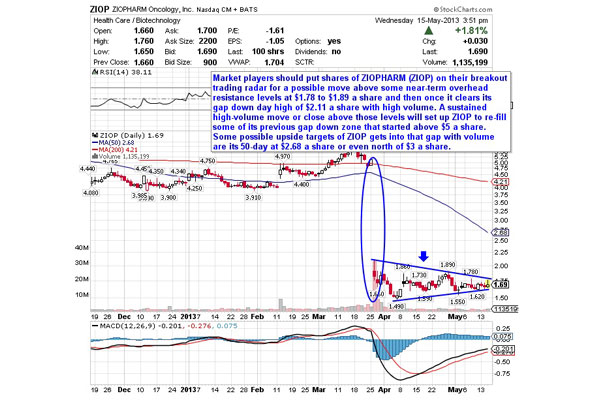

Another under-$10 name that's trending within range of triggering a major breakout trade is Ziopharm Oncology (ZIOP), which is engaged in the development and commercialization of small molecule and synthetic biology approaches to new cancer therapies. This stock has been destroyed by the sellers in 2013, with shares off by a whopping 59%.

>>4 Stocks Looking to Break Out

If you take a look at the chart for Ziopharm, you'll notice that this stock gapped down sharply in late March from over $5 a share to $1.66 a share with heavy downside volume. Following that gap down, shares of ZIOP have been trading inside of a consolidation and sideways chart pattern, with shares moving between $1.49 on the downside and $1.89 on the upside. Shares of ZIOP are now starting to move within range of triggering a major breakout trade above the upper-end of its recent sideways chart pattern.

Market players should now look for long-biased trades in ZIOP if it manages to break out above some near-term overhead resistance levels at $1.78 to $1.89 a share and then once it clears its gap down day high of $2.11 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 2.06 million shares. If that breakout triggers soon, then ZIOP will set up to re-fill some of its previous gap down zone that started above $5 a share. Some possible upside targets of ZIOP gets into that gap with volume are its 50-day at $2.68 a share or even north of $3 a share.

Traders can look to buy ZIOP off weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support levels at $1.62 to $1.55 a share, or even $1.49 a share. One can also buy ZIOP off strength once it clears those breakout levels with volume and then simply use a stop just below $1.62 a share. I would add to either position once ZIOP takes out its gap down day high at $2.11 a share with heavy upside volume.

Keep in mind that this stock is a favorite target of the short-sellers, since the current short interest as a percentage of the float for ZIOP is extremely high at 33.4%. If ZIOP triggers that breakout soon, then this stock could explode higher and squeeze the shorts that haven't covered large portions of their positions since the gap down.

Accuride

One more under-$10 name that looks ready to trigger a major breakout trade is Accuride (ACW), which manufacturers and supplies of commercial vehicle components in North America. This stock is off to a monster start in 2013, with shares up a whopping 76%.

If you take a look at the chart for Accuride, you'll notice that that this stock has been uptrending strong for the last month and change, with shares pushing higher from its low of $4.26 a share to its recent high of $5.73 a share. During that uptrend, shares of ACW have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of ACW within range of triggering a major breakout trade.

Traders should now look for long-biased trades in ACW if it manages to break out above some key overhead resistance levels at $5.74 to its 52-week high at $6.25 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 310,911 shares. If that breakout hits soon, then ACW will set up to re-test or possibly take out its next major overhead resistance levels at $7 to $8 a share, or even $9 a share.

Traders can look to buy ACW off weakness to anticipate that breakout and simply use a stop that sits just below its 50-day at $5.02 a share. One can also buy off strength once ACW clears those breakout levels with volume and then simply use a stop right below some key near-term support levels at $5.25 to $5.13 a share, or even its 50-day at $5.02 a share.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Madison, Wis.